Crowe RCA software monitors every patient financial transaction from more than 1,800 hospitals and 200,000 physicians nationwide for the purposes of automating hindsight, providing accounts receivable valuations and analyzing net revenue. Crowe leverages data gathered from clients on the Crowe RCA platform to monitor payor behaviors both within specific markets and nationally. Insights gleaned from this data aim to arm providers with actionable insights to support targeted performance discussions with their payors.

According to the report, about 45% of a typical hospital’s patient population has health insurance through a commercial carrier. While these payors reimburse providers at a higher amount on a per-case basis compared with traditional Medicare, their failure to pay in a timely manner is directly impacting hospitals’ financial performance. In the first quarter of 2023 alone, 31% of inpatient claims submitted by providers to commercial payors weren’t paid for more than three months. The percentage is less than half that for inpatient claims submitted to Medicare, at 12% over the same period.

“Historically, commercial payors paid claims faster than government plans because there was less red tape, but it is becoming increasingly more difficult for providers to receive payment from these insurers,” said Colleen Hall, managing principal of the healthcare group at Crowe. “How can we expect hospitals to financially recover when the payors that account for almost half of their business are holding onto a third of their claims payments for more than 90 days?”

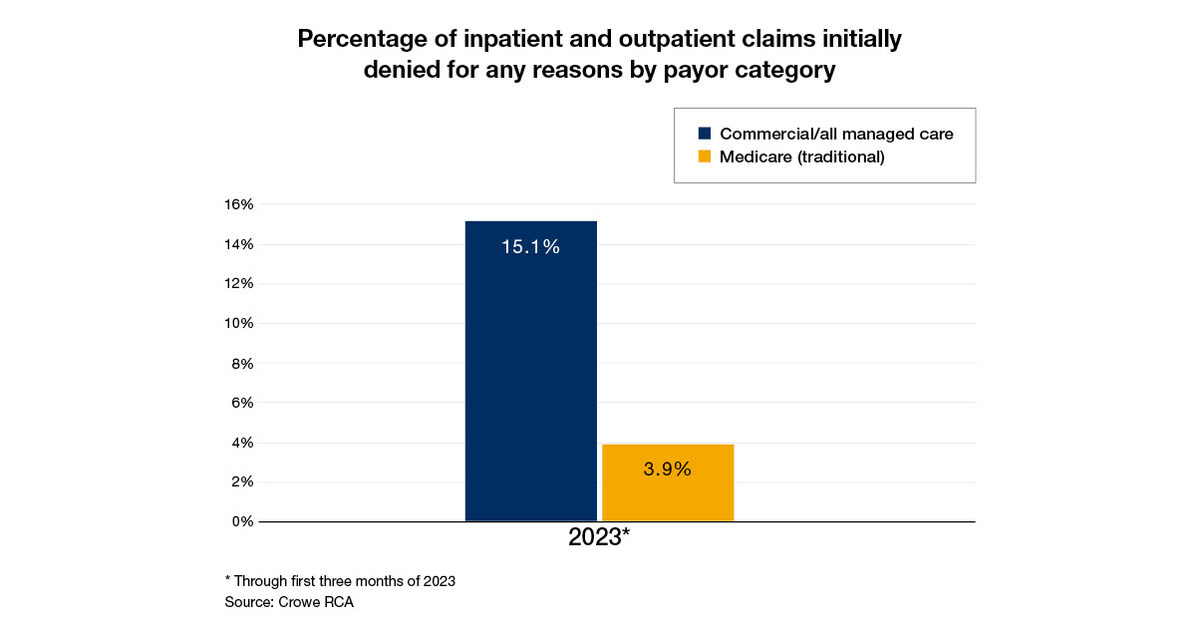

Traditional Medicare also fared better across prior authorization/precertification, initial and request for information (RFI) denial rates. Through the first quarter of 2023:

- Initial prior authorization/precertification denial rate for inpatient claims for commercial payors was 3.2% compared with 0.2% for Medicare.

- Commercial payors initially denied 15.1% of inpatient and outpatient claims for any reason compared with 3.9% for Medicare.

- The RFI denial rate for inpatient and outpatient claims submitted by providers to commercial payors was 4.8%, 12 times Medicare’s denial rate of 0.4%.

The report also reveals that on account of bad debt, final denials and takebacks, eight cents of every dollar providers bill to commercial payors will never be received or will be taken back once received. “Providers feel that they are being forced to jump through hoops and undergo labor-intensive processes in order to receive payment, especially from commercial payors,” said Hall. “During a time when labor shortages persist and expenses continue to rise, hospitals’ believe that their time and resources should be spent directly on patient care rather than managing increasingly bureaucratic reimbursement issues with insurers.”

To download a copy of the latest Crowe RCA report, please view “Time for a Commercial Break.”

About Crowe Revenue Cycle Analytics benchmarking data

Over 1,800 hospitals and more than 200,000 physicians use the Crowe RCA solution to capture every patient transaction for purposes of automating hindsight, providing accounts receivable valuations and analyzing net revenue. Crowe developed this proprietary benchmarking solution that monitors revenue cycle performance through normalized key performance indicators at healthcare organizations across 47 states and tracks over $800 billion in combined annual gross revenue.

About Crowe

Crowe LLP is a public accounting, consulting and technology firm with offices around the world. Crowe uses its deep industry expertise to provide audit services to public and private entities. The firm and its subsidiaries also help clients make smart decisions that lead to lasting value with its tax, advisory and consulting services, helping businesses uncover hidden opportunities in the market – no matter what challenges the markets present. Crowe is recognized by many organizations as one of the best places to work in the U.S. As an independent member of Crowe Global, one of the largest global accounting networks in the world, Crowe serves clients worldwide. The network consists of more than 200 independent accounting and advisory services firms in more than 130 countries around the world.

Twitter: @CroweUSA

LinkedIn: Crowe

SOURCE Crowe LLP