Even when the court impediment still exists, President Biden continues to console the American student population by predicting forgiveness on their educational loans.

A couple of months after the special pandemic reductions of student debts cease to support students in the USA, president Biden, the vice president, Harris and the nation’s Ministry of Education have proposed a 3-Part policy for students that will include loan forgiveness on their educational debts and many more allowances and reductions.

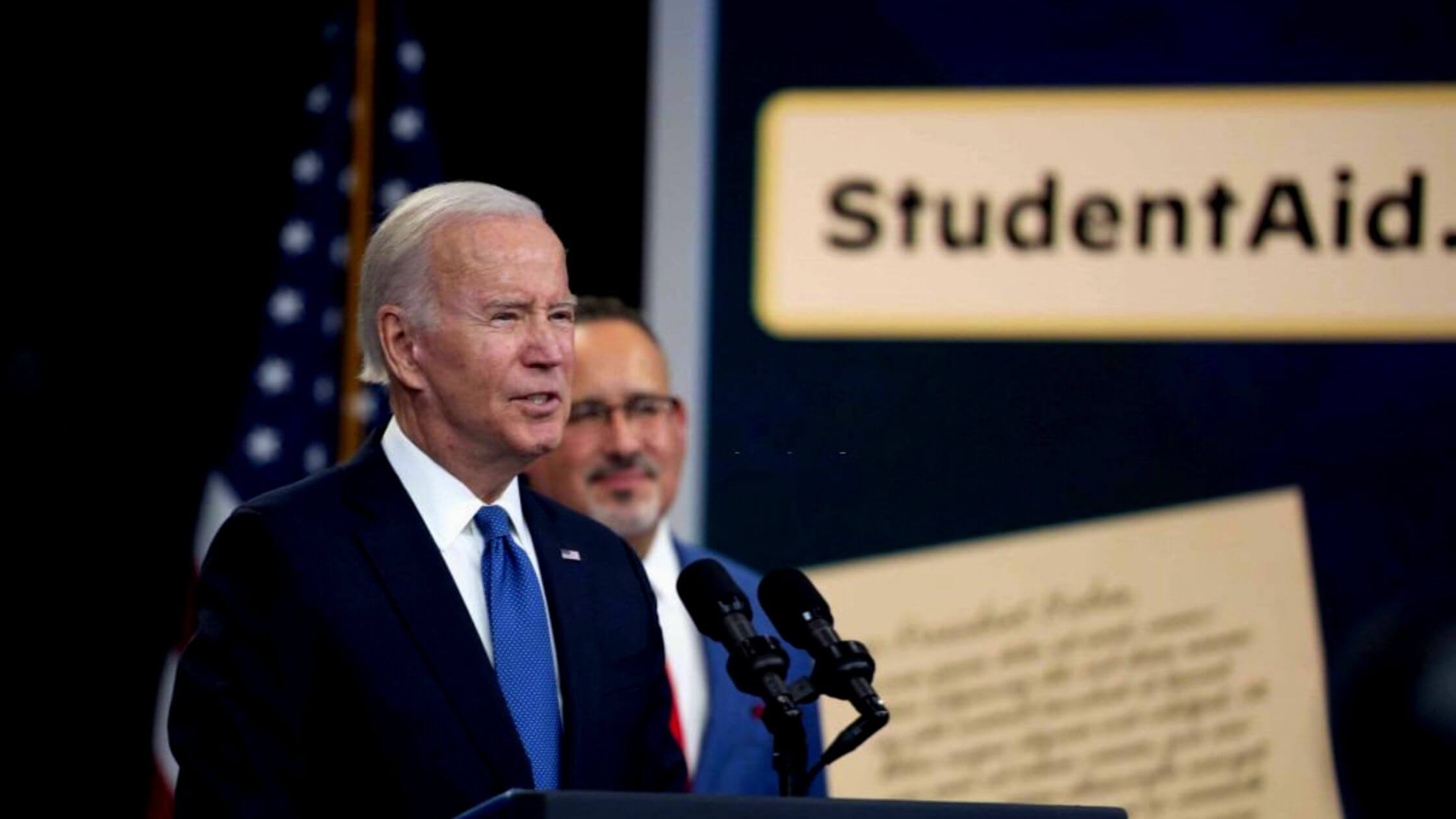

Biden Predicts That Student Loan Debt Will Be Relieved

The loan forgiveness is estimated to be 20,000 US Dollars. Meanwhile, the students and their families are in a state of confusion regarding the formalities and eligibility criteria to apply for the forgiveness scheme. Our sources also state that more allowances are expected to be announced in the upcoming days following up the 3-Part policy.

There is a case existing in the court regarding the differences in stances of the government and the jurisdiction regarding the policy in which the court expresses a denial of the relief. But the president has now expressed strong confidence in winning the case and moving forward with the loan forgiveness.

As a part of initiating the execution side of the plan, the government had started receiving applications since October 14th from the students. The government has also promised grant relief within a duration of 14 days which will owe to the reviewing and processing time. The grant is expected to be reflected in the respective bank statements rather than disbursing checks for the eligible applicants.

There is another notification for the students who can claim automated debt relief without a separate application form, regarding the expected due date of their relief. As per the same, such students would have to wait until the 14th of November to see a difference in the loan statements.

Apart from the hold posed by the court, the Arizona Attorney General Mark Brnovich, the conservative organizations such as the Job Creators Network Foundation, and the Cato Institute have also filed lawsuits against the 3-part policy put forward by the Biden government.

The loan payments for federal student borrowers started the last January, after a pause that was caused by the pandemic regulations of the government. Later on, in the month of August, Biden announced the loan relief for the first time.

The president was on his way to set a new deal on semiconductor manufacturing to Syracuse, New York, while he made clear his stances on loan forgiveness in an interview given to a local TV station network.

However, with the current hold ordered by the court on the loan forgiveness program, applications for the same are not available for the time being. The White House has also not yet given any kind of information regarding the date from which the applications will be made available.

As per the experts, the students are asked not to lag once the application forms are made accessible to the public. It is also advised to keep handy all the expected documents that are to be attached along with the application.

November 15-December 31 and December 31-January 31 are recorded as the crucial timeframes the student borrowers should keep their attention on, in order to apply and process for loan forgiveness.

Also, keep an eye on your income records to see whether you will be eligible for relief as per the eligibility criteria of the government. The criteria are set differently for individual students and students who are married or are the heads of the family.

At present, American federal students are curious about the upcoming two weeks and the final decision on the forgiveness program.