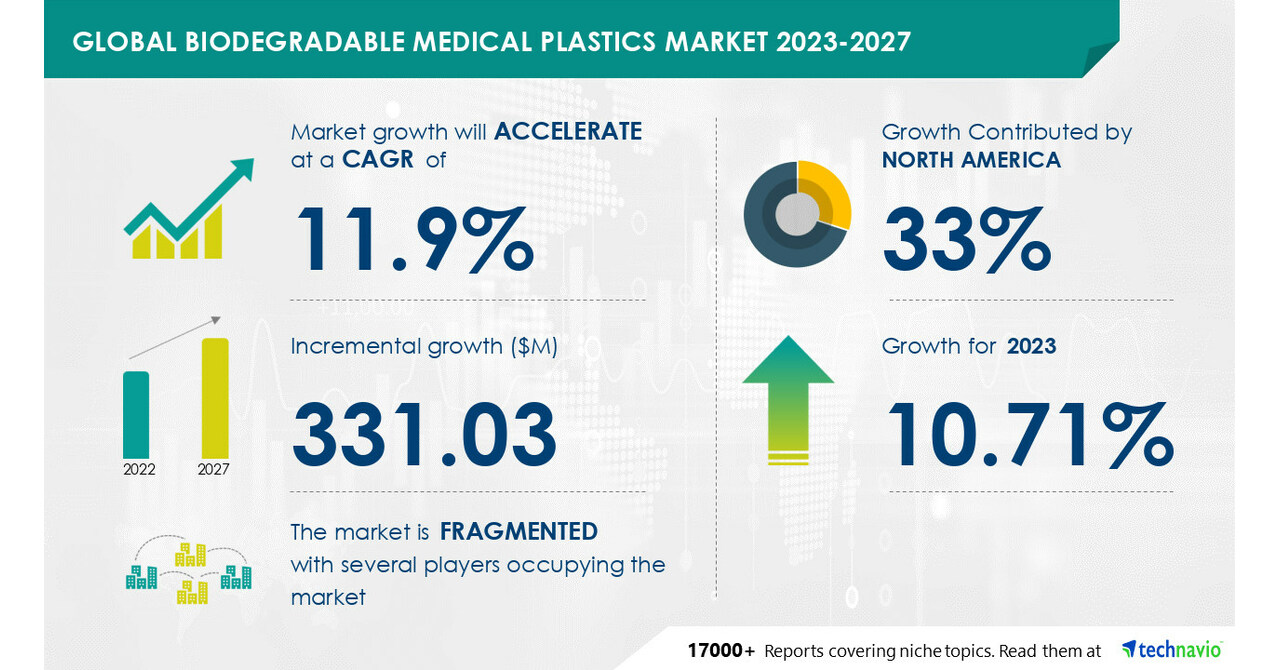

NEW YORK, June 1, 2023 /PRNewswire/ — The global biodegradable medical plastics market as a part of the specialty chemicals market. The biodegradable medical plastics market size is estimated to grow at a CAGR of 11.9% between 2022 and 2027. The primary factor fueling the expansion of the global biodegradable medical plastics market is consumers’ growing preference for environmentally friendly products. Many different types of medical products are made by manufacturers using plastics. Medical plastics are among the numerous waste products produced by hospitals.

Large-scale waste management is a difficult process. Hazardous waste is typically disposed of by hospitals, while the rest of the waste is sent to landfills. Most of the waste hospitals produced could be handled better if they switched to single-use, biodegradable products. Consumers of today are prioritizing sustainability and environmental awareness, which compels businesses to use sustainable practices in their products and services.

Discover some insights on market size historic period (2017 to 2021) and Forecast 2023-2027 before buying the full report – Request a sample report

Global Biodegradable medical plastics market – Customer Landscape

Our report analyzes the life cycle of the global biodegradable medical plastics market from the innovator’s stage to the laggard’s stage. The report illustrates the lifecycle of the global biodegradable medical plastics market, focusing on the adoption rates of the major countries such as the US, Canada, China, India, Japan, and Germany. To help companies evaluate and develop growth strategies for 2023-2027. To help companies evaluate and develop growth strategies, the report outlines –

- Key purchase criteria

- Adoption rates

- Adoption lifecycles

- Drivers of price sensitivity

- To unlock the detailed information on the customer landscape -, request a free sample now!

Global Biodegradable Medical Plastics Market – Vendor Analysis

Vendor Landscape – The global biodegradable medical plastics market is fragmented, with the presence of several global as well as regional vendors. A few prominent vendors that offer biodegradable medical plastics in the market are Arkema Group, Arthrex Inc., Ashland Inc., BASF SE, Bio on SpA, Celanese Corp., Corbion nv, Danimer Scientific Inc., Eastman Chemical Co., Kaneka Corp., Koninklijke DSM NV, Medtronic Plc, Mitsubishi Chemical Corp., Natupharma AS, NatureWorks LLC, Neste Corp., Nutricare Holding Pty Ltd, Surmodics Inc., TEYSHA TECHNOLOGIES LTD, and Evonik Industries AG and others.

The global biodegradable medical plastics market is at its growing stage. The major factor driving the expansion of the global biodegradable medical plastics market is consumers’ growing preference for environmentally friendly goods.

What’s New? –

- Special coverage on the Russia–Ukraine war; global inflation; recovery analysis from COVID-19; supply chain disruptions, global trade tensions; and risk of recession

- Global competitiveness and key competitor positions

- Market presence across multiple geographical footprints – Strong/Active/Niche/Trivial – Buy the report!

Vendor Offerings –

- Arkema Group: The company offers biodegradable medical plastics such as Rilsan polyamide 11 range and Oleris range.

- Arthrex Inc.: The company is involved in new product development and medical education in orthopedics.

- BASF SE: The company offers biodegradable medical plastics such as Ecoflex PBAT.

- For details on the vendor and its offerings – Request a sample report

Global Biodegradable Medical Plastics Market – Segmentation Assessment

Segment Overview

Technavio has segmented the market based Application (Medical devices, Medical packaging, and Others), Type (Poly lactic acid, Polyhydroxyalkanoates, Polybutylene succinate, Polycaprolactone, and Polyvinyl alcohol), and Geography (North America, Europe, APAC, Middle East and Africa, and South America).

- Medical devices are the equipment, machinery, and tools used to safely diagnose, treat, or cure an illness or disease. Medical thermometers, surgical sutures, disposable gloves, stents, bedpans, pacemakers, infusion pumps, and other tools are examples of common medical equipment. Drug delivery systems and implantable, single-use, disposable, and other medical devices are also included. Biodegradable medical plastics are widely used in the production of medical equipment. Medical device manufacturers frequently use polymers made from glycolic acid, polylactic acid (PLA), polydioxanone (PDO), and poly trimethylene carbonate (TMC).

In surgical procedures such as joint replacement, fracture fixation, and ligament, tendon, and bone defects repair, biodegradable implants are frequently used. Due to their advantages over non-biodegradable stainless implants, biodegradable implants are widely used in orthopedic surgeries. After the stainless-steel implant is removed, a broken bone that was previously fixed with it may refracture. The risk of refracturing is decreased by biodegradable polymer implants, which can be engineered to degrade at a rate that gradually transfers the load to the healing bone. The use of biodegradable polymer implants also eliminates the need for a second surgery to remove the implant after bone healing. As a result of the aforementioned advantages, the market for biodegradable medical implants is predicted to expand quickly.

As the world’s population ages, there are more people who suffer from hearing loss and related disorders. Data from The World Bank Group (WBG) shows that, for example, the population of people 65 and older worldwide increased by 10% between 2019 and 2021. This has increased the demand for medical devices made of biodegradable plastics, like hearing aids. The use of biodegradable medical plastics for site-specific drug delivery, such as coatings on medical devices or for the production of the devices themselves, is also gaining popularity. To achieve the controlled release of bioactive pharmaceuticals onto the surface of a medical device, (Surmodics) provide solutions. During the forecast period, these applications are expected to help the medical devices segment of the biodegradable medical plastics market grow.

Geography Overview

By geography, the global biodegradable medical plastics market is segmented into North America, Europe, APAC, Middle East and Africa, and South America. The report provides actionable insights and estimates the contribution of all regions to the growth of the global biodegradable medical plastics market.

- During the forecast period, North America’s biodegradable medical plastics market is anticipated to expand steadily. The US is the main factor driving the market’s expansion in North America. The forecasted growth of the biodegradable medical plastics market in North America will likely be influenced favorably by rising healthcare spending as well as the presence of hospitals and healthcare facilities with modern equipment. For instance, the Centers for Disease Control and Prevention (CDC) estimates that the US spent USD 4.3 trillion on healthcare overall in 2021. In North America, the population of elderly people is growing at a very rapid rate.

New laws that encourage the widespread use of bio-based materials have already begun to be implemented in North American nations. For example, the Pollution Prevention Act, also known as the P2 Law in the US, mandates that the EPA create a source reduction program to prevent or lessen pollution. Such regulations are probably going to increase demand in North America for bio-based products like biodegradable medical plastics.

For insights on global, regional, and country-level parameters with growth opportunities from 2017 to 2027 – Download a Sample Report

Global Biodegradable Medical Plastics Market – Market Dynamics Driver

Growing geriatric population: Globally, the percentage of older people has been rising. The population of many nations, including Japan, the UK, the US, and Germany, is aging rapidly. For instance, the WBG estimates that the percentage of people 65 and older in the world’s population increased by 10% in 2021 compared to 2019. Additionally, according to the United States Census Bureau (USCB), by 2030, there will be more elderly people living in the US than children. The USCB predicts that 77 million Americans will be 65 years of age or older by 2034, compared to 76.5 million Americans under the age of 18. Every country’s healthcare system will encounter a number of difficulties in addressing the needs of an aging population as the world population gets older. Falling and balance issues are more common in the elderly population. One of the main musculoskeletal conditions that affects the elderly and is brought on by the force of falls is low back pain. The elderly frequently experience balance issues, which can impair postural control.

A significant number of musculoskeletal disorders, including low back pain caused by falls and balance problems that can affect postural stability, are experienced by the elderly. Additionally, because elderly people are more prone to spinal and other orthopedic disorders, the prevalence of orthopedic disorders is higher among them. The most prevalent orthopedic disorders include arthritis, osteoarthritis, bursitis, rheumatoid arthritis, elbow pain, knee pain, hip fractures, and neck issues. The demand for medical products like implants and devices is anticipated to rise as a result of all these factors, which will propel the global biodegradable medical plastics market during the forecast period.

Trend

Adoption of innovative raw materials: The population of many nations, including Japan, the UK, the US, and Germany, is aging rapidly. For instance, the WBG estimates that the percentage of people 65 and older in the world’s population increased by 10% in 2021 compared to 2019. Additionally, according to the United States Census Bureau (USCB), by 2030, there will be more elderly people living in the US than children. The USCB predicts that 77 million Americans will be 65 years of age or older by 2034, compared to 76.5 million Americans under the age of 18. Every country’s healthcare system will encounter a number of difficulties in addressing the needs of an aging population as the world population gets older. Falling and balance issues are more common in the elderly population. One of the main musculoskeletal conditions that affect the elderly and are brought on by the force of falls is low back pain. The elderly frequently experience balance issues, which can impair postural control. Additionally, because elderly people are more prone to spinal and other orthopedic disorders, the prevalence of orthopedic disorders is higher among them. The most prevalent orthopedic disorders include arthritis, osteoarthritis, bursitis, rheumatoid arthritis, elbow pain, knee pain, hip fractures, and neck issues. The demand for medical products like implants and devices is anticipated to rise as a result of all these factors, which will propel the global biodegradable medical plastics market during the forecast period.

Challenge

High manufacturing cost: When compared to traditional medical plastics, biodegradable medical plastics are more expensive, which can pose a significant barrier to the market’s expansion. The main factor behind the high cost of biodegradable medical plastics is the scarcity of bio-based renewable feedstock, such as corn starch, vegetable fats and oils, straw, food waste, and woodchips. Vegetable oils have also become more expensive recently, including palm oil. For instance, in October 2021, the price of palm oil in Malaysia increased by roughly 68.54 percent compared to the previous year. Biodegradable medical plastics are expensive in part due to the erratic market prices of renewable raw materials like corn and sugarcane. Additionally, the manufacturing process for biodegradable medical plastics using agriculturally based raw materials is extremely complicated. R&D expenses account for a sizable portion of investment in biodegradable medical plastics and have an effect on material and product costs. The cost of producing biodegradable medical plastics will rise due to this increase in raw material prices, which will lower vendors’ profit margins. Vendors are thus compelled to increase prices in order to cover these expenses and pass them along to customers. During the forecast period, this could have a negative impact on the market.

Drivers, Trends and challenges have an impact on market dynamics, which can impact businesses. Find more insights in a sample report!

What are the key data covered in this Biodegradable Medical Plastics Market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the biodegradable medical plastics market between 2023 and 2027

- Precise estimation of the size of the biodegradable medical plastics market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the biodegradable medical plastics market industry across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of biodegradable medical plastics market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The biodegradable plastics market share should rise by 2,113.31 thousand tons from 2022 to 2026 at a CAGR of 22.07%. This biodegradable plastics market research report extensively covers market segmentation by end-user (packaging, consumer goods, textile, agriculture, and others) and geography (Europe, North America, APAC, South America, and MEA). The rise in consumer adoption of biodegradable plastics is notably driving the biodegradable plastics market growth, although factors such as higher prices of biodegradable plastics than conventional plastics may impede market growth.

The biodegradable packaging materials market is estimated to grow at a CAGR of 6.03% between 2022 and 2027. The size of the market is forecast to increase by USD 30,958.3 million. The growth of the market depends on several factors, including a shift toward the use of bioplastic packaging by end-users, government initiatives that promote the use of bioplastic packaging, and rising environmental stewardship. This report extensively covers market segmentation by application (food, beverage, pharmaceutical, personal and home care, and others), product (paper and bioplastics), and geography (Europe, North America, APAC, Middle East and Africa, and South America).

The medical plastics market share is expected to increase to USD 9.37 billion from 2021 to 2026, at a CAGR of 6.07%. This medical plastics market research report extensively covers the medical plastics market segmentation by automated production system (medical components, mobility aids, medical device packaging, and others) and geography (North America, Europe, APAC, and Rest of World (ROW)). The growth in the geriatric population is notably driving the medical plastics market growth, although factors such as the concerns related to the use of medical plastics may impede the market growth.

|

Biodegradable medical plastics market – Scope |

|

|

Report Coverage |

Details |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.9% |

|

Market growth 2023-2027 |

USD 331.03 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

10.71 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Japan, Germany, and France, Canada, Mexico, Italy,Spain, India, Japan, Australia, and South Korea |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arkema Group, Arthrex Inc., Ashland Inc., BASF SE, Bio on SpA, Celanese Corp., Corbion nv, Danimer Scientific Inc., Eastman Chemical Co., Kaneka Corp., Koninklijke DSM NV, Medtronic Plc, Mitsubishi Chemical Corp., Natupharma AS, NatureWorks LLC, Neste Corp., Nutricare Holding Pty Ltd, Surmodics Inc., TEYSHA TECHNOLOGIES LTD, and Evonik Industries AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Application

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global biodegradable medical plastics market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on Global biodegradable medical plastics market 2017 – 2021 ($ million)

- 4.2 Application Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Application Segment 2017 – 2021 ($ million)

- 4.3 Type Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – Type Segment 2017 – 2021 ($ million)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 ($ million)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Application

- 6.1 Market segments

- Exhibit 30: Chart on Application – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Application – Market share 2022-2027 (%)

- 6.2 Comparison by Application

- Exhibit 32: Chart on Comparison by Application

- Exhibit 33: Data Table on Comparison by Application

- 6.3 Medical devices – Market size and forecast 2022-2027

- Exhibit 34: Chart on Medical devices – Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Medical devices – Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Medical devices – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Medical devices – Year-over-year growth 2022-2027 (%)

- 6.4 Medical packaging – Market size and forecast 2022-2027

- Exhibit 38: Chart on Medical packaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Medical packaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Medical packaging – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Medical packaging – Year-over-year growth 2022-2027 (%)

- 6.5 Others – Market size and forecast 2022-2027

- Exhibit 42: Chart on Others – Market size and forecast 2022-2027 ($ million)

- Exhibit 43: Data Table on Others – Market size and forecast 2022-2027 ($ million)

- Exhibit 44: Chart on Others – Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Others – Year-over-year growth 2022-2027 (%)

- 6.6 Market opportunity by Application

- Exhibit 46: Market opportunity by Application ($ million)

- Exhibit 47: Data Table on Market opportunity by Application ($ million)

7 Market Segmentation by Type

- 7.1 Market segments

- Exhibit 48: Chart on Type – Market share 2022-2027 (%)

- Exhibit 49: Data Table on Type – Market share 2022-2027 (%)

- 7.2 Comparison by Type

- Exhibit 50: Chart on Comparison by Type

- Exhibit 51: Data Table on Comparison by Type

- 7.3 Poly lactic acid – Market size and forecast 2022-2027

- Exhibit 52: Chart on Poly lactic acid – Market size and forecast 2022-2027 ($ million)

- Exhibit 53: Data Table on Poly lactic acid – Market size and forecast 2022-2027 ($ million)

- Exhibit 54: Chart on Poly lactic acid – Year-over-year growth 2022-2027 (%)

- Exhibit 55: Data Table on Poly lactic acid – Year-over-year growth 2022-2027 (%)

- 7.4 Polyhydroxyalkanoates – Market size and forecast 2022-2027

- Exhibit 56: Chart on Polyhydroxyalkanoates – Market size and forecast 2022-2027 ($ million)

- Exhibit 57: Data Table on Polyhydroxyalkanoates – Market size and forecast 2022-2027 ($ million)

- Exhibit 58: Chart on Polyhydroxyalkanoates – Year-over-year growth 2022-2027 (%)

- Exhibit 59: Data Table on Polyhydroxyalkanoates – Year-over-year growth 2022-2027 (%)

- 7.5 Polybutylene succinate – Market size and forecast 2022-2027

- Exhibit 60: Chart on Polybutylene succinate – Market size and forecast 2022-2027 ($ million)

- Exhibit 61: Data Table on Polybutylene succinate – Market size and forecast 2022-2027 ($ million)

- Exhibit 62: Chart on Polybutylene succinate – Year-over-year growth 2022-2027 (%)

- Exhibit 63: Data Table on Polybutylene succinate – Year-over-year growth 2022-2027 (%)

- 7.6 Polycaprolactone – Market size and forecast 2022-2027

- Exhibit 64: Chart on Polycaprolactone – Market size and forecast 2022-2027 ($ million)

- Exhibit 65: Data Table on Polycaprolactone – Market size and forecast 2022-2027 ($ million)

- Exhibit 66: Chart on Polycaprolactone – Year-over-year growth 2022-2027 (%)

- Exhibit 67: Data Table on Polycaprolactone – Year-over-year growth 2022-2027 (%)

- 7.7 Polyvinyl alcohol – Market size and forecast 2022-2027

- Exhibit 68: Chart on Polyvinyl alcohol – Market size and forecast 2022-2027 ($ million)

- Exhibit 69: Data Table on Polyvinyl alcohol – Market size and forecast 2022-2027 ($ million)

- Exhibit 70: Chart on Polyvinyl alcohol – Year-over-year growth 2022-2027 (%)

- Exhibit 71: Data Table on Polyvinyl alcohol – Year-over-year growth 2022-2027 (%)

- 7.8 Market opportunity by Type

- Exhibit 72: Market opportunity by Type ($ million)

- Exhibit 73: Data Table on Market opportunity by Type ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 74: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 75: Chart on Market share by geography 2022-2027 (%)

- Exhibit 76: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 77: Chart on Geographic comparison

- Exhibit 78: Data Table on Geographic comparison

- 9.3 North America – Market size and forecast 2022-2027

- Exhibit 79: Chart on North America – Market size and forecast 2022-2027 ($ million)

- Exhibit 80: Data Table on North America – Market size and forecast 2022-2027 ($ million)

- Exhibit 81: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 82: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.4 Europe – Market size and forecast 2022-2027

- Exhibit 83: Chart on Europe – Market size and forecast 2022-2027 ($ million)

- Exhibit 84: Data Table on Europe – Market size and forecast 2022-2027 ($ million)

- Exhibit 85: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 86: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.5 APAC – Market size and forecast 2022-2027

- Exhibit 87: Chart on APAC – Market size and forecast 2022-2027 ($ million)

- Exhibit 88: Data Table on APAC – Market size and forecast 2022-2027 ($ million)

- Exhibit 89: Chart on APAC – Year-over-year growth 2022-2027 (%)

- Exhibit 90: Data Table on APAC – Year-over-year growth 2022-2027 (%)

- 9.6 Middle East and Africa – Market size and forecast 2022-2027

- Exhibit 91: Chart on Middle East and Africa – Market size and forecast 2022-2027 ($ million)

- Exhibit 92: Data Table on Middle East and Africa – Market size and forecast 2022-2027 ($ million)

- Exhibit 93: Chart on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- Exhibit 94: Data Table on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- 9.7 South America – Market size and forecast 2022-2027

- Exhibit 95: Chart on South America – Market size and forecast 2022-2027 ($ million)

- Exhibit 96: Data Table on South America – Market size and forecast 2022-2027 ($ million)

- Exhibit 97: Chart on South America – Year-over-year growth 2022-2027 (%)

- Exhibit 98: Data Table on South America – Year-over-year growth 2022-2027 (%)

- 9.8 US – Market size and forecast 2022-2027

- Exhibit 99: Chart on US – Market size and forecast 2022-2027 ($ million)

- Exhibit 100: Data Table on US – Market size and forecast 2022-2027 ($ million)

- Exhibit 101: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 102: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.9 Germany – Market size and forecast 2022-2027

- Exhibit 103: Chart on Germany – Market size and forecast 2022-2027 ($ million)

- Exhibit 104: Data Table on Germany – Market size and forecast 2022-2027 ($ million)

- Exhibit 105: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 106: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.10 France – Market size and forecast 2022-2027

- Exhibit 107: Chart on France – Market size and forecast 2022-2027 ($ million)

- Exhibit 108: Data Table on France – Market size and forecast 2022-2027 ($ million)

- Exhibit 109: Chart on France – Year-over-year growth 2022-2027 (%)

- Exhibit 110: Data Table on France – Year-over-year growth 2022-2027 (%)

- 9.11 China – Market size and forecast 2022-2027

- Exhibit 111: Chart on China – Market size and forecast 2022-2027 ($ million)

- Exhibit 112: Data Table on China – Market size and forecast 2022-2027 ($ million)

- Exhibit 113: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 114: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.12 Japan – Market size and forecast 2022-2027

- Exhibit 115: Chart on Japan – Market size and forecast 2022-2027 ($ million)

- Exhibit 116: Data Table on Japan – Market size and forecast 2022-2027 ($ million)

- Exhibit 117: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 118: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 119: Market opportunity by geography ($ million)

- Exhibit 120: Data Tables on Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.3 Impact of drivers and challenges

- Exhibit 121: Impact of drivers and challenges in 2022 and 2027

11 Vendor Landscape

- 11.2 Vendor landscape

- Exhibit 122: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 123: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 124: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 125: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 126: Matrix on vendor position and classification

- 12.3 Arkema Group

- Exhibit 127: Arkema Group – Overview

- Exhibit 128: Arkema Group – Business segments

- Exhibit 129: Arkema Group – Key news

- Exhibit 130: Arkema Group – Key offerings

- Exhibit 131: Arkema Group – Segment focus

- 12.4 Arthrex Inc.

- Exhibit 132: Arthrex Inc. – Overview

- Exhibit 133: Arthrex Inc. – Product / Service

- Exhibit 134: Arthrex Inc. – Key offerings

- 12.5 Ashland Inc.

- Exhibit 135: Ashland Inc. – Overview

- Exhibit 136: Ashland Inc. – Business segments

- Exhibit 137: Ashland Inc. – Key news

- Exhibit 138: Ashland Inc. – Key offerings

- Exhibit 139: Ashland Inc. – Segment focus

- 12.6 BASF SE

- Exhibit 140: BASF SE – Overview

- Exhibit 141: BASF SE – Business segments

- Exhibit 142: BASF SE – Key news

- Exhibit 143: BASF SE – Key offerings

- Exhibit 144: BASF SE – Segment focus

- 12.7 Bio on SpA

- Exhibit 145: Bio on SpA – Overview

- Exhibit 146: Bio on SpA – Product / Service

- Exhibit 147: Bio on SpA – Key offerings

- 12.8 Celanese Corp.

- Exhibit 148: Celanese Corp. – Overview

- Exhibit 149: Celanese Corp. – Business segments

- Exhibit 150: Celanese Corp. – Key offerings

- Exhibit 151: Celanese Corp. – Segment focus

- 12.9 Corbion nv

- Exhibit 152: Corbion nv – Overview

- Exhibit 153: Corbion nv – Business segments

- Exhibit 154: Corbion nv – Key news

- Exhibit 155: Corbion nv – Key offerings

- Exhibit 156: Corbion nv – Segment focus

- 12.10 Danimer Scientific Inc.

- Exhibit 157: Danimer Scientific Inc. – Overview

- Exhibit 158: Danimer Scientific Inc. – Product / Service

- Exhibit 159: Danimer Scientific Inc. – Key offerings

- 12.11 Eastman Chemical Co.

- Exhibit 160: Eastman Chemical Co. – Overview

- Exhibit 161: Eastman Chemical Co. – Business segments

- Exhibit 162: Eastman Chemical Co. – Key offerings

- Exhibit 163: Eastman Chemical Co. – Segment focus

- 12.12 Evonik Industries AG

- Exhibit 164: Evonik Industries AG – Overview

- Exhibit 165: Evonik Industries AG – Business segments

- Exhibit 166: Evonik Industries AG – Key news

- Exhibit 167: Evonik Industries AG – Key offerings

- Exhibit 168: Evonik Industries AG – Segment focus

- 12.13 Kaneka Corp.

- Exhibit 169: Kaneka Corp. – Overview

- Exhibit 170: Kaneka Corp. – Business segments

- Exhibit 171: Kaneka Corp. – Key offerings

- Exhibit 172: Kaneka Corp. – Segment focus

- 12.14 Koninklijke DSM NV

- Exhibit 173: Koninklijke DSM NV – Overview

- Exhibit 174: Koninklijke DSM NV – Business segments

- Exhibit 175: Koninklijke DSM NV – Key news

- Exhibit 176: Koninklijke DSM NV – Key offerings

- Exhibit 177: Koninklijke DSM NV – Segment focus

- 12.15 Medtronic Plc

- Exhibit 178: Medtronic Plc – Overview

- Exhibit 179: Medtronic Plc – Business segments

- Exhibit 180: Medtronic Plc – Key news

- Exhibit 181: Medtronic Plc – Key offerings

- Exhibit 182: Medtronic Plc – Segment focus

- 12.16 Mitsubishi Chemical Corp.

- Exhibit 183: Mitsubishi Chemical Corp. – Overview

- Exhibit 184: Mitsubishi Chemical Corp. – Business segments

- Exhibit 185: Mitsubishi Chemical Corp. – Key news

- Exhibit 186: Mitsubishi Chemical Corp. – Key offerings

- Exhibit 187: Mitsubishi Chemical Corp. – Segment focus

- 12.17 NatureWorks LLC

- Exhibit 188: NatureWorks LLC – Overview

- Exhibit 189: NatureWorks LLC – Product / Service

- Exhibit 190: NatureWorks LLC – Key offerings

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 191: Inclusions checklist

- Exhibit 192: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 193: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 194: Research methodology

- Exhibit 195: Validation techniques employed for market sizing

- Exhibit 196: Information sources

- 13.5 List of abbreviations

- Exhibit 197: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com

SOURCE Technavio