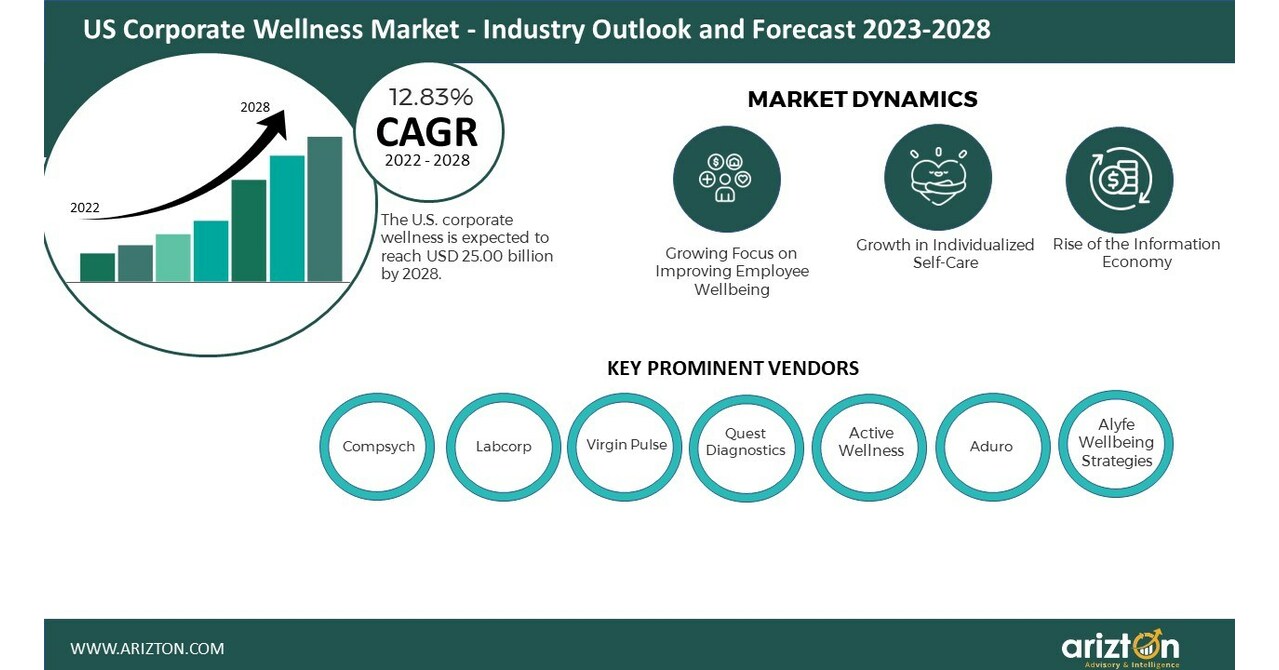

CHICAGO, June 13, 2023 /PRNewswire/ — According to Arizton’s latest research report, the US corporate wellness market will grow at a CAGR of 12.83% during 2022-2028.

To know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3843

The US business landscape is at an intersection where companies are doing well. Still, employees go through epidemic levels of stress and depression due to more responsibilities, a dwindling workforce, a toxic office environment, and others. Unhealthy lifestyles that constitute inactivity, smoking, and bad nutrition spiral healthcare costs out of control. The long-term impact of these issues on the quality of life and performance of employees is significant. This and the colossal healthcare costs in the US warrant the need for corporate wellness programs to sustain a thriving standard of high-quality life. The US’s leading drivers for health and wellness programs are the need for healthy eating, exercise, a high prevalence of obesity, and the reduction of insurance and healthcare costs. Corporate profits that recorded an uptick after a long period of sluggish growth also fuel the adoption of wellness programs. This puts employees in a better place in terms of being able to allocate budgets for corporate wellness programs. Therefore, the US corporate wellness market is expected to grow in the upcoming years.

U.S. Corporate Wellness Market Report Scope

|

Report Attributes |

Details |

|

Market Size (2028) |

USD 25 Billion |

|

Market Size (2022) |

USD 12.12 Billion |

|

CAGR (2022-2028) |

12.83 % |

|

Base Year |

2022 |

|

Forecast Year |

2023-2028 |

|

MARKET Segmentation |

Program, Revenue Model, Delivery Model, Incentive Programs, Type, Industry, End-user, and Region |

|

Regional Analysis |

U.S. (South, West, Midwest, and Northeast) |

|

Market Dynamics |

|

Looking for More Information? Download the Free Sample Report: https://www.arizton.com/request-sample/3843

Almost 50% of employers in the US offer financial wellness programs in sync with their retirement plans. Larger employers already offer programs in this space, while smaller ones work on implementing them. Companies also focus on certain benefits over others, such as debt counseling services and emergency savings accounts during the pandemic. Tuition reimbursement and discount programs are not so popular. Caregiving loans, short-term loans, emergency funds, debt management services, and payroll advances are increasingly used by employees. There is also increased emphasis on short-term financial wellness, particularly concerning healthcare. Employers increasingly look to address retirement preparedness and healthcare costs with financial wellness programs.

Key Insights

- Employers in the US are more concerned about protecting their employees from financial, physical, and mental challenges to help them to get through the immediate impact of COVID-19. This, in turn, brought a significant wave to the demand for corporate wellness in the US.

- In 2022 the US corporate wellness market was valued at $12.12 billion. It is expected to grow at a CAGR of 12.83% during the forecast period.

- Based on the program, HRA dominated the market in revenue with a market share of 16.29% in 2022.

- In 2022, the large private sector businesses held most of the market share by end-user segment at 43.97%. In contrast, medium private sector businesses are expected to grow at the fastest growth rate at a CAGR of 12.92% during the forecast period.

- The corporate wellness market is divided into onsite and offsite segments based on delivery mode. In 2022, the onsite segment dominated the market with a revenue share of 77.49% during the forecast period.

- Wellness programs can change corporate culture, and employers thus take measures to improve their employees’ work-life balance and lifestyle by shaping new behavioral norms. More companies introduce corporate wellness programs, which will, in turn, put pressure on their competitors to follow suit as healthcare benefits are among the most valued benefits among employees in the US.

Analysis of Opportunities & Challenges

The way social media evolved over the last couple of years and subsequently deepened its roots in various sectors is commendable. Social media is now synonymous with wide reach and awareness of various issues. It became a widely used platform for a wide and varied population due to its popularity and ease of use. It is one of the fastest ways to reach the masses and spread the word.

Several social media platforms fit various purposes and people. If Snapchat is widely popular amongst youngsters, LinkedIn can connect to professionals. Nevertheless, certain topics are relevant to the entire population irrespective of profession, background, interests, or culture, such as wellness, be it mental, physical, or both. Given the popularity amassed and the amount of time an average individual spends in a day scrolling through social media, it is the best and the fastest way to spread awareness regarding mental and physical wellness. Using relevant hashtags can turn a discussion into a trending topic, thus gaining popularity and the necessary attention from corporate wellness vendors.

Employees in the US changed the way they think about wellness. A new perspective is evolving wherein making healthy choices is not restricted outside work hours as new generations enter the workforce and technology advances. Incorporating workplaces’ gyms, games, and nap rooms reflects the changing attitude. The office changed from a traditional utilitarian space to an environment where employees thrive and bring out their best. Once constricted to the home environment, wellness is increasingly a part of the workspace that promotes long-term health solutions as people spend a good portion of their day at work. Employees grow more aware of what work does to them regarding burnout and are looking within the workspace to control stress levels.

- About 75% of employees take time to work their muscles by walking, stretching, and working out or jogging during the workday.

- About 53% of employees spent little time ensuring their mental health was on track during the workday.

Many employees look for inspiration at work to stay fit, make new healthy habits, and alter old unhealthy ones. The office provides structural support that is more difficult to attain at home, so wellness programs have good scope for growth.

Vendor Insights

Over the past couple of years, however, the market witnessed the entry of many external players, such as in-house services by large businesses and other entities, in the health and fitness space that offer membership discounts to drive up their share in the market. M&As are common within the industry as players look to expand and become more comprehensive in their offerings. A trend witnessed among vendors in a landscape where consolidation occurs is the focus on merging two platforms. Resources are spent on merging rather than innovation as large players join hands.

Buy the Report Now: https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

Key Questioned Answered in the Report:

- How big is the U.S. corporate wellness market?

- What is the growth rate of the U.S. corporate wellness market?

- What are the growing trends in the U.S. corporate wellness market?

- Which region holds the most significant U.S. corporate wellness market share?

- Who are the key players in the U.S. corporate wellness market?

Key Company Profiles

- Compsych

- Labcorp

- Virgin Pulse

- Quest Diagnostics

- Active Wellness

- Aduro

- Alyfe Wellbeing Strategies

- American Specialty Health

- Aquila

- AYCO

- Bank of America Merill Lynch

- BaySport

- Beacon Health Options

- Best Money Moves

- Brightdime

- Brightside

- BSDI

- Castlight Health

- Ceridian

- Corporate Fitness Works

- DHS Group

- Edukate

- Elite Wellness

- Enrich

- Even

- EXOS

- Financial Fitness Group

- Financial Knowledge

- FlexWage

- GoPlan 101

- HealthCheck360

- HealthFitness

- HealthTrax

- Holberg Financial

- Health Advocate

- Integrated Wellness Partners

- Karelia Health

- Kersh Health

- Kinema Fitness

- LearnLux

- LifeCents

- LifeDojo

- LifeStart

- Limeade

- LIVunLtd

- Marino Wellness

- Marathon Health

- Mercer

- Midtown Athletic Club

- Money Starts Here

- My Secure Advantage

- NIFS

- OptumHealth

- Orriant

- Payactiv

- Power Wellness

- Premise Health

- Privia Health

- Professional Fitness Management

- Prudential Financial

- Purchasing Power

- Ramsey Solutions

- Reach Fitness

- Sonic Boom Wellness

- Sprout

- StayWell

- Transamerica

- Vantage Circle

- Vitality Group

- Wellable

- Wellness Coaches USA

- Wellsource

- WellSteps

- Wisdom Works Group

- Woliba

- Workstride

- WTS International

- Origin

- BrightPlan

- Savology

- Sqwire

- FinFit

- Pro Financial Health

- FutureFuel.io

- Salary Finance

- SoFi

- Sum180

- The Financial Gym

- PDHI

- Novant Health

Market Segmentation

Program

- HRA

- Nutrition & Weight Management

- Smoking Cessation

- Fitness Services

- Alcohol & Drug Rehab

- Stress Management

- Health Education Services

- Financial Wellness

- Others

Revenue Model

- Recurring Revenue Model

- Seasonal Revenue Model

Delivery Model

Incentive Programs

- Participatory Programs

- Health-Contingent Programs

Type

Industry

- Media and Technology

- Healthcare

- Financial Services

- Manufacturing

- Retail

- Others

End-user

- Large Private Sector Businesses

- Medium Private Sector Businesses

- Public Sector Companies

- Small Private Sector Businesses

- Non-Profit Organizations

Region

- The US

- South

- West

- Midwest

- Northeast

Check Out Some of the Top-Selling Research Reports:

U.S. Employee Assistance Program Services Market – Industry Outlook and Forecast 2022-2027: The U.S. employee assistance program services market is expected to grow at a CAGR of over 11% from 2022 to 2027.

Mental Wellness Market – Global Outlook & Forecast 2022-2027: The global mental wellness market size is expected to grow at a CAGR of 6.35% during 2022-2027.

U.S. Financial Wellness Benefits Market – Industry Outlook & Forecast 2022-2027: The U.S. financial wellness benefits market is expected to grow at a CAGR of 13.71%.

U.S. Workplace Stress Management Market – Industry Outlook & Forecast 2022-2027: The U.S. workplace stress management market is expected to grow at a CAGR of 8.25% during 2022-2027.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY PROGRAM

4.3.2 MARKET SEGMENTATION BY END-USER

4.3.3 MARKET SEGMENTATION BY REVENUE MODEL

4.3.4 MARKET SEGMENTATION BY DELIVERY MODEL

4.3.5 MARKET SEGMENTATION BY INCENTIVE PROGRAM

4.3.6 MARKET SEGMENTATION BY TYPE

4.3.7 MARKET SEGMENTATION BY INDUSTRY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 MARKET DEFINITION

7.2 REPORT OVERVIEW

7.2.1 MARKET SNAPSHOT

7.3 VENDOR & EMPLOYER RIGHTS, OBLIGATIONS & PRICING MODELS

7.4 WORKPLACE MENTAL HEALTH & WELLBEING

7.5 ANALYSIS OF OPPORTUNITIES & CHALLENGES

7.6 SEGMENT ANALYSIS

7.7 REGIONAL ANALYSIS

7.8 COMPETITIVE LANDSCAPE

7.9 FREQUENTLY ASKED QUESTIONS

8 INTRODUCTION

8.1 OVERVIEW

8.1.1 COST OF STRESS TO US CORPORATE CAUSED DUE TO FINANCIAL PROBLEMS & OTHER ISSUES

8.1.2 PLANNING GUIDELINES FOR WELLNESS PROGRAMS

8.1.3 SUCCESS FACTORS FOR WELLNESS PROGRAMS

8.1.4 MEGATRENDS IN CORPORATE WELLNESS, 2021

8.1.5 DECLINING TRENDS IN CORPORATE WELLNESS, 2021

8.1.6 GROWTH & DECLINE IN TREND ANALYSIS, 2021

8.2 WORKPLACE MENTAL HEALTH & WELLBEING

8.3 STATE OF US HEALTHCARE

8.3.1 WELLBEING IN THE US BY STATE

8.4 VENDOR & EMPLOYER RIGHTS, OBLIGATIONS & PRICING MODELS

8.5 REGULATORY FRAMEWORK

8.5.1 HIPAA

8.5.2 EQUAL EMPLOYMENT OPPORTUNITY COMMISSION (EEOC)

8.5.3 OTHER REGULATORY CONSIDERATIONS FOR WELLNESS PROGRAM VENDORS

8.5.4 BUSINESS MODEL

8.5.5 PILLARS OF CORPORATE WELLNESS

8.6 LIFECYCLE STAGE OF THE US CORPORATE WELLNESS MARKET

8.7 GROWTH PROSPECTS

8.8 SUPPLY CHAIN

8.9 AMERICAN WORKFORCE ANALYSIS

8.10 FACTORS THAT INFLUENCE DEMAND: HEALTHY EATING INDEX

8.11 EMPLOYEE BEHAVIOR INSIGHTS

8.11.1 MILLENNIALS

8.11.2 GENERATION X

8.11.3 BABY BOOMERS

8.12 ECONOMIC & DEMOGRAPHICAL ANALYSES

8.12.1 POPULATION

8.12.2 INCOME

8.12.3 GENERATION & AGE TRENDS

8.12.4 RACIAL/ETHNIC TRENDS

8.13 KEY DECISION INFLUENCERS

8.13.1 TECHNOLOGY COMPANIES

8.13.2 FITNESS COMPANIES

8.13.3 BENEFITS CONSULTANTS

8.13.4 ARCHITECTURE FIRMS

9 MARKET OPPORTUNITIES & TRENDS

9.1 ROLE OF WELLNESS CHAMPIONS

9.2 WELLNESS DRIVEN BY DATA ANALYTICS

9.3 USE OF TECHNOLOGY TO IMPROVE OUTCOMES

9.4 REIGN OF ARTIFICIAL INTELLIGENCE

9.5 EXTENSION OF WELLNESS PROGRAMS TO FAMILIES

9.6 OFFERING MULTIPLE SOLUTIONS UNDER ONE ROOF

9.7 INCORPORATION OF SOCIAL CONNECTEDNESS

9.8 INCREASED PENETRATION OF TELEHEALTH

9.9 MENTAL & PHYSICAL HEALTH AWARENESS ON SOCIAL MEDIA

10 MARKET GROWTH ENABLERS

10.1 IMPROVEMENTS IN EMPLOYEE WELLBEING DUE TO COVID-19

10.2 INCREASED INDIVIDUALIZED SELFCARE

10.3 RISE OF INFORMATION ECONOMY

10.4 EVOLUTION OF VALUE PROPOSITION

10.5 INCREASED WORKING HOURS

10.6 BROAD SHIFT IN WELLNESS PERSPECTIVES

10.7 REDUCTION OF LOAD ON US HEALTHCARE SYSTEMS BY CORPORATE WELLNESS PROGRAMS

10.8 HIKE IN ATTRITION

10.9 HEALTH ISSUES DUE TO WORK STRESS

11 MARKET RESTRAINTS

11.1 REMOTE WORK & INCREASED SURVEILLANCE BY EMPLOYERS

11.2 CONSTANT STRUGGLE FOR EMPLOYEE ENGAGEMENT & PARTICIPATION

11.3 PERCEIVED EXPENSIVENESS OF WELLNESS PROGRAMS

11.4 WARINESS REGARDING MISUSE OF DATA

11.5 FALSE PROMISES OF WELLNESS PROGRAMS

11.6 INCREASED SENSE OF ANXIETY

11.7 SINGULAR APPROACH TO WELLNESS

11.8 LACK OF GENDER-SPECIFIC APPROACH

11.9 DEARTH OF CULTURAL SUPPORT

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.1.1 DYNAMICS FOR FAST-GROWING CORPORATE WELLNESS PROGRAM: FINANCIAL WELLNESS

12.1 PEST ANALYSIS

12.1.1 POLITICAL

12.1.2 ECONOMIC

12.1.3 SOCIAL

12.1.4 TECHNOLOGY

12.2 MARKET SIZE & FORECAST

12.3 INDUSTRY

12.3.1 MARKET SIZE & FORECAST

12.4 END-USER

12.4.1 MARKET SIZE & FORECAST

12.5 INCENTIVE PROGRAM

12.5.1 MARKET SIZE & FORECAST

12.6 DELIVERY

12.6.1 MARKET SIZE & FORECAST

12.7 TYPE

12.7.1 MARKET SIZE & FORECAST

12.8 REVENUE MODEL

12.8.1 MARKET SIZE & FORECAST

12.9 PROGRAM

12.9.1 MARKET SIZE & FORECAST

12.10 FIVE FORCES ANALYSIS

12.10.1 THREAT OF NEW ENTRANTS

12.10.2 BARGAINING POWER OF SUPPLIERS

12.10.3 BARGAINING POWER OF BUYERS

12.10.4 THREAT OF SUBSTITUTES

12.10.5 COMPETITIVE RIVALRY

13 PROGRAM

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 HRA

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY REGION

13.4 NUTRITION & WEIGHT MANAGEMENT

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY REGION

13.5 SMOKING CESSATION

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY REGION

13.6 FITNESS SERVICES

13.6.1 MARKET OVERVIEW

13.6.2 MARKET SIZE & FORECAST

13.6.3 MARKET BY REGION

13.7 ALCOHOL & DRUG REHAB

13.7.1 MARKET OVERVIEW

13.7.2 MARKET SIZE & FORECAST

13.7.3 MARKET BY REGION

13.8 STRESS MANAGEMENT

13.8.1 MARKET OVERVIEW

13.8.2 MARKET SIZE & FORECAST

13.8.3 MARKET BY REGION

13.9 HEALTH EDUCATION SERVICES

13.9.1 MARKET OVERVIEW

13.9.2 MARKET SIZE & FORECAST

13.9.3 MARKET BY REGION

13.10 FINANCIAL WELLNESS

13.10.1 MARKET OVERVIEW

13.10.2 MARKET SIZE & FORECAST

13.10.3 MARKET BY REGION

13.11 OTHERS

13.11.1 MARKET OVERVIEW

13.11.2 MARKET SIZE & FORECAST

13.11.3 MARKET BY REGION

14 REVENUE MODEL

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 RECURRING REVENUE MODEL

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY REGION

14.4 SEASONAL REVENUE MODEL

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY REGION

15 DELIVERY MODEL

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 ONSITE

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY REGION

15.4 OFFSITE

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY REGION

16 INCENTIVE PROGRAM

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 PARTICIPATORY PROGRAMS

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.3.3 MARKET BY REGION

16.4 HEALTH-CONTINGENT PROGRAMS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.4.3 MARKET BY REGION

17 TYPE

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 MARKET OVERVIEW

17.3 SERVICE

17.3.1 MARKET OVERVIEW

17.3.2 MARKET SIZE & FORECAST

17.3.3 MARKET BY REGION

17.4 TECHNOLOGY

17.4.1 MARKET OVERVIEW

17.4.2 MARKET SIZE & FORECAST

17.4.3 MARKET BY REGION

18 INDUSTRY

18.1 MARKET SNAPSHOT & GROWTH ENGINE

18.2 MARKET OVERVIEW

18.3 MEDIA & TECHNOLOGY

18.3.1 MARKET OVERVIEW

18.3.2 MARKET SIZE & FORECAST

18.3.3 MARKET BY REGION

18.4 HEALTHCARE

18.4.1 MARKET OVERVIEW

18.4.2 MARKET SIZE & FORECAST

18.4.3 MARKET BY REGION

18.5 FINANCIAL SERVICES

18.5.1 MARKET OVERVIEW

18.5.2 MARKET SIZE & FORECAST

18.5.3 MARKET BY REGION

18.6 MANUFACTURING

18.6.1 MARKET OVERVIEW

18.6.2 MARKET SIZE & FORECAST

18.6.3 MARKET BY REGION

18.7 RETAIL

18.7.1 MARKET OVERVIEW

18.7.2 MARKET SIZE & FORECAST

18.7.3 MARKET BY REGION

18.8 OTHERS

18.8.1 MARKET OVERVIEW

18.8.2 MARKET SIZE & FORECAST

18.8.3 MARKET BY REGION

19 END-USER

19.1 MARKET SNAPSHOT & GROWTH ENGINE

19.2 MARKET OVERVIEW

19.3 LARGE PRIVATE SECTOR BUSINESSES

19.3.1 MARKET OVERVIEW

19.3.2 MARKET SIZE & FORECAST

19.3.3 MARKET BY REGION

19.4 MEDIUM PRIVATE SECTOR BUSINESSES

19.4.1 MARKET OVERVIEW

19.4.2 MARKET SIZE & FORECAST

19.4.3 MARKET BY REGION

19.5 PUBLIC SECTOR COMPANIES

19.5.1 MARKET OVERVIEW

19.5.2 MARKET SIZE & FORECAST

19.5.3 MARKET BY REGION

19.6 SMALL PRIVATE SECTOR BUSINESSES

19.6.1 MARKET OVERVIEW

19.6.2 MARKET SIZE & FORECAST

19.6.3 MARKET BY REGION

19.7 NON-PROFIT ORGANIZATIONS

19.7.1 MARKET OVERVIEW

19.7.2 MARKET SIZE & FORECAST

19.7.3 MARKET BY REGION

20 REGION

20.1 MARKET SNAPSHOT & GROWTH ENGINE

20.2 REGIONAL OVERVIEW

21 SOUTH

21.1 MARKET OVERVIEW

21.1.1 TEXAS

21.1.2 FLORIDA

21.2 MARKET SIZE & FORECAST

21.3 INDUSTRY

21.3.1 MARKET SIZE & FORECAST

21.4 END-USER

21.4.1 MARKET SIZE & FORECAST

21.5 INCENTIVE PROGRAM

21.5.1 MARKET SIZE & FORECAST

21.6 DELIVERY MODEL

21.6.1 MARKET SIZE & FORECAST

21.7 TYPE

21.7.1 MARKET SIZE & FORECAST

21.8 REVENUE MODEL

21.8.1 MARKET SIZE & FORECAST

21.9 PROGRAM

21.9.1 MARKET SIZE & FORECAST

22 WEST

22.1 MARKET OVERVIEW

22.1.1 CALIFORNIA

22.1.2 WASHINGTON

22.2 MARKET SIZE & FORECAST

22.3 INDUSTRY

22.3.1 MARKET SIZE & FORECAST

22.4 END-USER

22.4.1 MARKET SIZE & FORECAST

22.5 INCENTIVE PROGRAM

22.5.1 MARKET SIZE & FORECAST

22.6 DELIVERY MODEL

22.6.1 MARKET SIZE & FORECAST

22.7 TYPE

22.7.1 MARKET SIZE & FORECAST

22.8 REVENUE MODEL

22.8.1 MARKET SIZE & FORECAST

22.9 PROGRAM

22.9.1 MARKET SIZE & FORECAST

23 MIDWEST

23.1 MARKET OVERVIEW

23.1.1 ILLINOIS

23.1.2 MICHIGAN

23.2 MARKET SIZE & FORECAST

23.3 INDUSTRY

23.3.1 MARKET SIZE & FORECAST

23.4 END-USER

23.4.1 MARKET SIZE & FORECAST

23.5 INCENTIVE PROGRAM

23.5.1 MARKET SIZE & FORECAST

23.6 DELIVERY MODEL

23.6.1 MARKET SIZE & FORECAST

23.7 TYPE

23.7.1 MARKET SIZE & FORECAST

23.8 REVENUE MODEL

23.8.1 MARKET SIZE & FORECAST

23.9 PROGRAM

23.9.1 MARKET SIZE & FORECAST

24 NORTHEAST

24.1 MARKET OVERVIEW

24.1.1 NEW YORK

24.1.2 NEW JERSEY

24.2 MARKET SIZE & FORECAST

24.3 INDUSTRY

24.3.1 MARKET SIZE & FORECAST

24.4 END-USER

24.4.1 MARKET SIZE & FORECAST

24.5 INCENTIVE PROGRAM

24.5.1 MARKET SIZE & FORECAST

24.6 DELIVERY MODEL

24.6.1 MARKET SIZE & FORECAST

24.7 TYPE

24.7.1 MARKET SIZE & FORECAST

24.8 REVENUE MODEL

24.8.1 MARKET SIZE & FORECAST

24.9 PROGRAM

24.9.1 MARKET SIZE & FORECAST

25 COMPETITIVE LANDSCAPE

Check the detailed table of contents of the report @ https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024?details=tableOfContents

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Contact Us: https://www.arizton.com/contact-us

Blog: https://www.arizton.com/blog

Website: https://www.arizton.com/

Photo: https://mma.prnewswire.com/media/2099948/US_CorporateWellness_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/4084117/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence