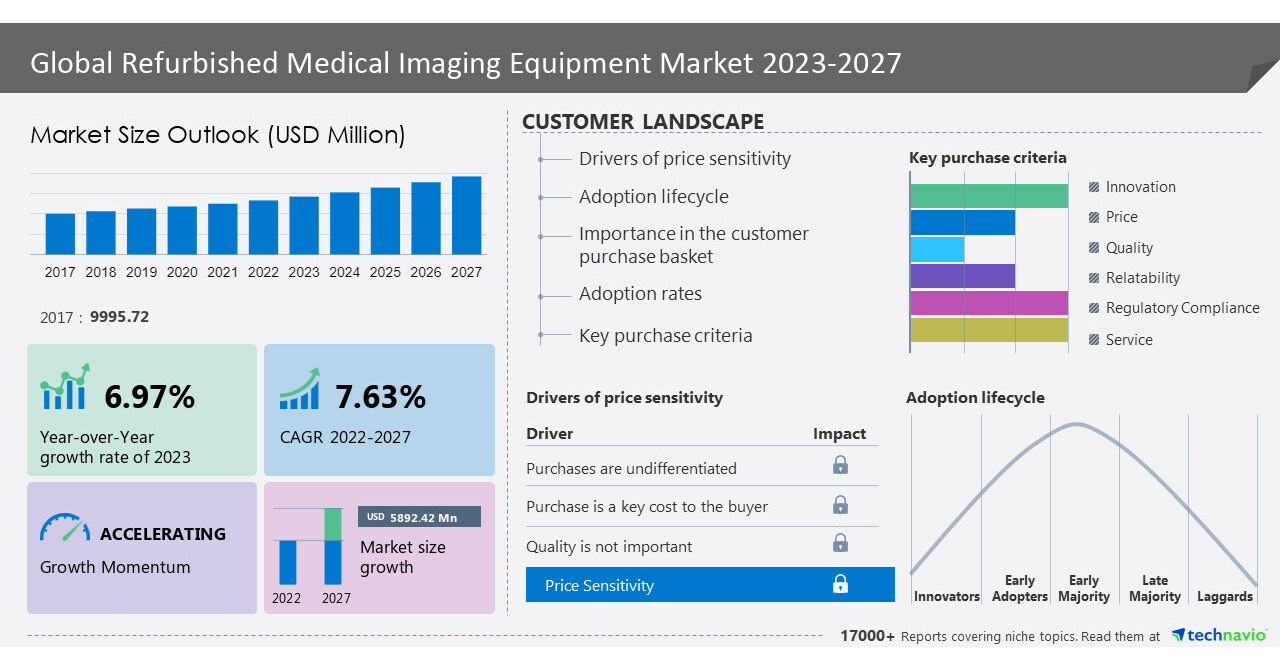

NEW YORK, June 13, 2023 /PRNewswire/ — The global refurbished medical imaging equipment market size is estimated to increase by USD 5,892 million from 2023 to 2027. The market’s growth momentum will be progressing at a CAGR of 7.63%. Increasing sales through online marketing is driving the growth of the refurbished medical imaging equipment market. The prime focus of online services is to deliver customers advantages such as minimizing set-up, sales, and operating costs. However, vendors market their playback devices in a variety of ways, including holding promotional events at various medical institutions, participating in industry trade shows, and sponsoring various medical events. To attract new customers, there is an increasing demand for online marketing. The marketing strategies of vendors, such as discounted pricing and promotional offers on single and bulk purchases of imaging devices, increase the number of online sales. Moreover, there are no such limitations of time to purchasing a product online, at their convenience, customers can purchase the product. Also, the manufacturers provide a warranty and guarantee even for the products offered online. Therefore, the growth in online marketing services is anticipated to contribute to the sales of refurbished medical imaging equipment during the forecast period.

Discover some insights on the market size historic period (2017 to 2021) and Forecast

2023-2027 before buying the full report – Request a sample report

Refurbished medical imaging equipment market – Customer Landscape

Our report analyzes the life cycle of the global refurbished medical imaging equipment market from the innovator’s stage to the laggard’s stage. The report illustrates the lifecycle of the global refurbished medical imaging equipment market, focusing on the adoption rates of major countries such as the US, Canada, China, India, Japan, and Germany. To help companies evaluate and develop growth strategies for 2023-2027. To help companies evaluate and develop growth strategies, the report outlines –

- Key purchase criteria

- Adoption rates

- Adoption lifecycles

- Drivers of price sensitivity

- To unlock the detailed information on the customer landscape -, request a free sample now!

Refurbished medical imaging equipment market – Vendor Analysis

Vendor Landscape –

The global refurbished medical imaging equipment market is fragmented, with the presence of several global as well as regional vendors. A few prominent vendors that offer refurbished medical imaging equipment in the market are AGITO Medical, Avante Health Solutions, Block Imaging Inc., EverX Pty Ltd., Fair Medical Co. Ltd., GE Healthcare Technologies Inc., Hi Tech International Group Inc., Hilditch Group Ltd, Integrity Medical Systems Inc., Koninklijke Philips NV, MASTER MEDICAL SYSTEMS PVT LTD, Nationwide Imaging Services Inc, Pacific Healthcare Imaging, Radiology Oncology Systems Inc., Siemens Healthineers AG, SOMA TECH INTL, Ultra Imaging Solutions LLC., US Med-Equip, Venture Medical ReQuip Inc., and WHITTEMORE ENTERPRISES INC. and others.

What’s New? –

- Special coverage on the Russia–Ukraine war; global inflation; recovery analysis from COVID-19; supply chain disruptions, global trade tensions; and risk of recession

- Global competitiveness and key competitor positions

- Market presence across multiple geographical footprints – Strong/Active/Niche/Trivial – Buy the report!

Vendor Offerings –

- AGITO Medical- The company offers refurbished medical imaging equipment such as Mammography, Ultrasound, and C arms.

- Avante Health Solutions- The company offers refurbished medical imaging equipment such as Autoclaves, Fluoroscopy machines, and Angio.

- Block Imaging Inc.- The company offers refurbished medical imaging equipment such as Interventional, Molecular, and Dexa.

- For details on the vendor and its offerings – Request a sample report

Refurbished Medical Imaging Equipment Market – Segmentation Assessment

Segment Overview

Technavio has segmented the market based on type, product (X-ray imaging, ultrasound systems, MRI, CT scanner imaging, and SPECT/ PET scanners), end-user (hospitals and diagnostic centers), and geography (North America, Europe, Asia, and Rest of World (ROW)).

- The X-ray imaging segment will account for a major share of the market growth. An X-ray is a non-invasive test that produces /images of the internal structures of a body by exposing the body to a small dose of ionizing radiation. It is the most common test used in more than 50% of imaging procedures in hospitals. There is a rising demand for refurbished X-ray devices, which is mainly attributed to the rising popularity of digital radiography (DR) systems. However, there is an increased demand for mobile C-arm X-ray systems with advanced features to use in a variety of diagnostic imaging and minimally invasive surgical procedures. The emerging markets are witnessing increasing upgrading of analog X-ray systems to digital X-ray systems. Generally, digital X-ray systems are expensive and are classified as capital equipment that requires budget allocation and high maintenance, which makes this equipment more expensive. Due to this, many hospitals and diagnostic centres are looking for a cost-effective solution for the adoption of advanced X-ray systems. Refurbished X-ray devices, which are upgraded to advanced CR or DR systems, are a cost-effective and efficient alternative for these customers. Hence, this is expected to boost the demand for refurbished general X-ray systems during the forecast period.

Geography Overview

By geography, the global refurbished medical imaging equipment market is segmented into North America, Europe, Asia, and the Rest of the World (ROW). The report provides actionable insights and estimates the contribution of all regions to the growth of the global refurbished medical imaging equipment market.

- North America is estimated to contribute 33% to the growth of the global market during the forecast period. The majority share of the region is attributed to the rise in cardiovascular diseases, musculoskeletal disorders, and cancer; favourable regulatory policy for refurbished medical imaging equipment; and reduced insurance coverage for some medical imaging procedures. However, the United States is the largest earner in the region, followed by Canada. Nowadays, the markets in Mexico are also witnessing an upsurge in revenue generated annually. In the US, the sale, purchase, and usage of refurbished medical devices are unrestricted. There are no FDA regulations on the resale of medical devices unless there are modifications in the original specifications of the device. The FDA, however, recommends that manufacturers replace the parts of the devices only from OEM and not from other sources. Therefore, these factors will drive the market growth in this region during the forecast period.

For insights on global, regional, and country-level parameters with growth opportunities

from 2017 to 2027 – Download a Sample Report

Refurbished Medical Imaging Equipment Market – Market Dynamics

Key Trends – Increasing consultation services and support by vendors is the primary trend shaping the global refurbished medical imaging equipment market growth. The vendors in the market have started offering consultation, planning, system installation, configuration, and other technical services to their customers. This benefits vendors and OEMs to design and incorporate new parts and technologies in the refurbished devices, according to the end-user preferences. The global vendors are offering high-quality, eco-friendly systems with a warranty, ideal service plans, and real-time support to attract more customers. Furthermore, Philips Healthcare also offers training and education, financial and leasing, business consultancy, and clinical services, including maintenance and repair. Also, GE Healthcare provides transformational medical technologies and services, as well as consulting services. Therefore, these services and support by the manufacturers drive the market growth.

Major challenges – Concerns regarding quality, safety, and efficacy are a major challenge impeding the growth of the global refurbished medical imaging equipment market. Wrong interpretations in the output of the medical /image led to increased risks for patients and affect the credibility of the staff. However, the reluctance of OEMs or manufacturers to share their updated software and technologies with third-party vendors of medical equipment has consistently made it challenging for refurbishing firms to deliver maintenance services for the devices. These factors are estimated to limit the growth of the refurbished medical imaging equipment market. Furthermore, to quality issues, the distributors of refurbished medical imaging equipment do not offer full product warranties like new devices. In some cases, the systems fail due to the usage of non-OEM parts, raising safety concerns for the staff as well as the patients. Hence, quality, safety, and durability concerns have a negative effect on the growth of the global refurbished imaging medical equipment market.

Drivers, Trends and challenges have an impact on market dynamics, which can impact

businesses. Find more insights in a sample report! , find some insights from a free

sample report!

What are the key data covered in this Refurbished Medical Imaging Equipment Market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the Refurbished Medical Imaging Equipment Market between 2023 and 2027

- Precise estimation of the size of the Refurbished Medical Imaging Equipment Market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the Refurbished Medical Imaging Equipment Market industry across North America, Europe, Asia, and Rest of World (ROW)

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of Refurbished Medical Imaging Equipment Market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The robotic medical imaging systems market share is expected to increase by USD 621.24 million from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 14.1%. This report extensively covers robotic medical imaging systems market segmentation by product (X-ray, ultrasound, MRI, and CT-scan) and geography (North America, Europe, APAC, South America, and the Middle East and Africa). The increasing prevalence of chronic diseases is one of the major drivers impacting the robotic medical imaging systems market growth.

The medical imaging phantom market share is expected to increase by USD 63.11 million from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 6.7%. This report extensively covers the medical imaging phantom market segmentation by end-user (hospitals, diagnostic laboratories, and academic and research) and geography (North America, Europe, Asia, and the Rest of the World (ROW)). The increasing prevalence of chronic conditions such as cardiac failure, chronic kidney disease, and Chronic Obstructive Pulmonary Disease (COPD) is one of the key drivers supporting the medical imaging phantom market growth.

|

Refurbished Medical Imaging Equipment Market Scope |

|

|

Report Coverage |

Details |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.63% |

|

Market growth 2023-2027 |

USD 5,892.42 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

6.97 |

|

Regional analysis |

North America, Europe, Asia, and the Rest of the World (ROW) |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, Germany, UK, China, Japan, Canada, Mexico, Italy, Spain, India, Japan, Australia, and South Korea |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGITO Medical, Avante Health Solutions, Block Imaging Inc., EverX Pty Ltd., Fair Medical Co. Ltd., GE Healthcare Technologies Inc., Hi Tech International Group Inc., Hilditch Group Ltd, Integrity Medical Systems Inc., Koninklijke Philips NV, MASTER MEDICAL SYSTEMS PVT LTD, Nationwide Imaging Services Inc, Pacific Healthcare Imaging, Radiology Oncology Systems Inc., Siemens Healthineers AG, SOMA TECH INTL, Ultra Imaging Solutions LLC., US Med-Equip, Venture Medical ReQuip Inc., and WHITTEMORE ENTERPRISES INC. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of content

1 Executive Summary

- 1.1 Market Overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global refurbished medical imaging equipment market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on global refurbished medical imaging equipment market 2017 – 2021 ($ million)

- 4.2 Product Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Product Segment 2017 – 2021 ($ million)

- 4.3 End-user Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – End-user Segment 2017 – 2021 ($ million)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 ($ million)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Product

- 6.1 Market segments

- Exhibit 30: Chart on Product – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Product – Market share 2022-2027 (%)

- 6.2 Comparison by Product

- Exhibit 32: Chart on Comparison by Product

- Exhibit 33: Data Table on Comparison by Product

- 6.3 X-ray imaging – Market size and forecast 2022-2027

- Exhibit 34: Chart on X-ray imaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on X-ray imaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on X-ray imaging – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on X-ray imaging – Year-over-year growth 2022-2027 (%)

- 6.4 Ultrasound systems – Market size and forecast 2022-2027

- Exhibit 38: Chart on Ultrasound systems – Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Ultrasound systems – Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Ultrasound systems – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Ultrasound systems – Year-over-year growth 2022-2027 (%)

- 6.5 MRI – Market size and forecast 2022-2027

- Exhibit 42: Chart on MRI – Market size and forecast 2022-2027 ($ million)

- Exhibit 43: Data Table on MRI – Market size and forecast 2022-2027 ($ million)

- Exhibit 44: Chart on MRI – Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on MRI – Year-over-year growth 2022-2027 (%)

- 6.6 CT scanner imaging – Market size and forecast 2022-2027

- Exhibit 46: Chart on CT scanner imaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 47: Data Table on CT scanner imaging – Market size and forecast 2022-2027 ($ million)

- Exhibit 48: Chart on CT scanner imaging – Year-over-year growth 2022-2027 (%)

- Exhibit 49: Data Table on CT scanner imaging – Year-over-year growth 2022-2027 (%)

- 6.7 SPECT/ PET scanners – Market size and forecast 2022-2027

- Exhibit 50: Chart on SPECT/ PET scanners – Market size and forecast 2022-2027 ($ million)

- Exhibit 51: Data Table on SPECT/ PET scanners – Market size and forecast 2022-2027 ($ million)

- Exhibit 52: Chart on SPECT/ PET scanners – Year-over-year growth 2022-2027 (%)

- Exhibit 53: Data Table on SPECT/ PET scanners – Year-over-year growth 2022-2027 (%)

- 6.8 Market opportunity by Product

- Exhibit 54: Market opportunity by Product ($ million)

- Exhibit 55: Data Table on Market opportunity by Product ($ million)

7 Market Segmentation by End-user

- 7.1 Market segments

- Exhibit 56: Chart on End-user – Market share 2022-2027 (%)

- Exhibit 57: Data Table on End-user – Market share 2022-2027 (%)

- 7.2 Comparison by End-user

- Exhibit 58: Chart on Comparison by End-user

- Exhibit 59: Data Table on Comparison by End-user

- 7.3 Hospitals – Market size and forecast 2022-2027

- Exhibit 60: Chart on Hospitals – Market size and forecast 2022-2027 ($ million)

- Exhibit 61: Data Table on Hospitals – Market size and forecast 2022-2027 ($ million)

- Exhibit 62: Chart on Hospitals – Year-over-year growth 2022-2027 (%)

- Exhibit 63: Data Table on Hospitals – Year-over-year growth 2022-2027 (%)

- 7.4 Diagnostic centers – Market size and forecast 2022-2027

- Exhibit 64: Chart on Diagnostic centers – Market size and forecast 2022-2027 ($ million)

- Exhibit 65: Data Table on Diagnostic centers – Market size and forecast 2022-2027 ($ million)

- Exhibit 66: Chart on Diagnostic centers – Year-over-year growth 2022-2027 (%)

- Exhibit 67: Data Table on Diagnostic centers – Year-over-year growth 2022-2027 (%)

- 7.5 Market opportunity by End-user

- Exhibit 68: Market opportunity by End-user ($ million)

- Exhibit 69: Data Table on Market opportunity by End-user ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 70: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 71: Chart on Market share by geography 2022-2027 (%)

- Exhibit 72: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 73: Chart on Geographic comparison

- Exhibit 74: Data Table on Geographic comparison

- 9.3 North America – Market size and forecast 2022-2027

- Exhibit 75: Chart on North America – Market size and forecast 2022-2027 ($ million)

- Exhibit 76: Data Table on North America – Market size and forecast 2022-2027 ($ million)

- Exhibit 77: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 78: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.4 Europe – Market size and forecast 2022-2027

- Exhibit 79: Chart on Europe – Market size and forecast 2022-2027 ($ million)

- Exhibit 80: Data Table on Europe – Market size and forecast 2022-2027 ($ million)

- Exhibit 81: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 82: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.5 Asia – Market size and forecast 2022-2027

- Exhibit 83: Chart on Asia – Market size and forecast 2022-2027 ($ million)

- Exhibit 84: Data Table on Asia – Market size and forecast 2022-2027 ($ million)

- Exhibit 85: Chart on Asia – Year-over-year growth 2022-2027 (%)

- Exhibit 86: Data Table on Asia – Year-over-year growth 2022-2027 (%)

- 9.6 Rest of World (ROW) – Market size and forecast 2022-2027

- Exhibit 87: Chart on Rest of World (ROW) – Market size and forecast 2022-2027 ($ million)

- Exhibit 88: Data Table on Rest of World (ROW) – Market size and forecast 2022-2027 ($ million)

- Exhibit 89: Chart on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- Exhibit 90: Data Table on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- 9.7 US – Market size and forecast 2022-2027

- Exhibit 91: Chart on US – Market size and forecast 2022-2027 ($ million)

- Exhibit 92: Data Table on US – Market size and forecast 2022-2027 ($ million)

- Exhibit 93: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 94: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.8 China – Market size and forecast 2022-2027

- Exhibit 95: Chart on China – Market size and forecast 2022-2027 ($ million)

- Exhibit 96: Data Table on China – Market size and forecast 2022-2027 ($ million)

- Exhibit 97: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 98: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.9 Japan – Market size and forecast 2022-2027

- Exhibit 99: Chart on Japan – Market size and forecast 2022-2027 ($ million)

- Exhibit 100: Data Table on Japan – Market size and forecast 2022-2027 ($ million)

- Exhibit 101: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 102: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.10 Germany – Market size and forecast 2022-2027

- Exhibit 103: Chart on Germany – Market size and forecast 2022-2027 ($ million)

- Exhibit 104: Data Table on Germany – Market size and forecast 2022-2027 ($ million)

- Exhibit 105: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 106: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.11 UK – Market size and forecast 2022-2027

- Exhibit 107: Chart on UK – Market size and forecast 2022-2027 ($ million)

- Exhibit 108: Data Table on UK – Market size and forecast 2022-2027 ($ million)

- Exhibit 109: Chart on UK – Year-over-year growth 2022-2027 (%)

- Exhibit 110: Data Table on UK – Year-over-year growth 2022-2027 (%)

- 9.12 Market opportunity by geography

- Exhibit 111: Market opportunity by geography ($ million)

- Exhibit 112: Data Tables on Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.3 Impact of drivers and challenges

- Exhibit 113: Impact of drivers and challenges in 2022 and 2027

11 Vendor Landscape

- 11.2 Vendor landscape

- Exhibit 114: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 115: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 116: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 117: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 118: Matrix on vendor position and classification

- 12.3 AGITO Medical

- Exhibit 119: AGITO Medical – Overview

- Exhibit 120: AGITO Medical – Product / Service

- Exhibit 121: AGITO Medical – Key offerings

- 12.4 Avante Health Solutions

- Exhibit 122: Avante Health Solutions – Overview

- Exhibit 123: Avante Health Solutions – Product / Service

- Exhibit 124: Avante Health Solutions – Key offerings

- 12.5 Block Imaging Inc.

- Exhibit 125: Block Imaging Inc. – Overview

- Exhibit 126: Block Imaging Inc. – Product / Service

- Exhibit 127: Block Imaging Inc. – Key offerings

- 12.6 EverX Pty Ltd.

- Exhibit 128: EverX Pty Ltd. – Overview

- Exhibit 129: EverX Pty Ltd. – Product / Service

- Exhibit 130: EverX Pty Ltd. – Key offerings

- 12.7 GE Healthcare Technologies Inc.

- Exhibit 131: GE Healthcare Technologies Inc. – Overview

- Exhibit 132: GE Healthcare Technologies Inc. – Business segments

- Exhibit 133: GE Healthcare Technologies Inc. – Key offerings

- Exhibit 134: GE Healthcare Technologies Inc. – Segment focus

- 12.8 Hilditch Group Ltd

- Exhibit 135: Hilditch Group Ltd – Overview

- Exhibit 136: Hilditch Group Ltd – Product / Service

- Exhibit 137: Hilditch Group Ltd – Key offerings

- 12.9 Integrity Medical Systems Inc.

- Exhibit 138: Integrity Medical Systems Inc. – Overview

- Exhibit 139: Integrity Medical Systems Inc. – Product / Service

- Exhibit 140: Integrity Medical Systems Inc. – Key offerings

- 12.10 Koninklijke Philips NV

- Exhibit 141: Koninklijke Philips NV – Overview

- Exhibit 142: Koninklijke Philips NV – Business segments

- Exhibit 143: Koninklijke Philips NV – Key news

- Exhibit 144: Koninklijke Philips NV – Key offerings

- Exhibit 145: Koninklijke Philips NV – Segment focus

- 12.11 MASTER MEDICAL SYSTEMS PVT LTD

- Exhibit 146: MASTER MEDICAL SYSTEMS PVT LTD – Overview

- Exhibit 147: MASTER MEDICAL SYSTEMS PVT LTD – Product / Service

- Exhibit 148: MASTER MEDICAL SYSTEMS PVT LTD – Key offerings

- 12.12 Radiology Oncology Systems Inc.

- Exhibit 149: Radiology Oncology Systems Inc. – Overview

- Exhibit 150: Radiology Oncology Systems Inc. – Product / Service

- Exhibit 151: Radiology Oncology Systems Inc. – Key offerings

- 12.13 Siemens Healthineers AG

- Exhibit 152: Siemens Healthineers AG – Overview

- Exhibit 153: Siemens Healthineers AG – Business segments

- Exhibit 154: Siemens Healthineers AG – Key news

- Exhibit 155: Siemens Healthineers AG – Key offerings

- Exhibit 156: Siemens Healthineers AG – Segment focus

- 12.14 SOMA TECH INTL

- Exhibit 157: SOMA TECH INTL – Overview

- Exhibit 158: SOMA TECH INTL – Product / Service

- Exhibit 159: SOMA TECH INTL – Key offerings

- 12.15 Ultra Imaging Solutions LLC.

- Exhibit 160: Ultra Imaging Solutions LLC. – Overview

- Exhibit 161: Ultra Imaging Solutions LLC. – Product / Service

- Exhibit 162: Ultra Imaging Solutions LLC. – Key offerings

- 12.16 US Med Equip

- Exhibit 163: US Med Equip – Overview

- Exhibit 164: US Med Equip – Product / Service

- Exhibit 165: US Med Equip – Key offerings

- 12.17 WHITTEMORE ENTERPRISES INC.

- Exhibit 166: WHITTEMORE ENTERPRISES INC. – Overview

- Exhibit 167: WHITTEMORE ENTERPRISES INC. – Product / Service

- Exhibit 168: WHITTEMORE ENTERPRISES INC. – Key offerings

13 Appendix

- 13.2 Inclusions and exclusions checklist

- Exhibit 169: Inclusions checklist

- Exhibit 170: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 171: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 172: Research methodology

- Exhibit 173: Validation techniques employed for market sizing

- Exhibit 174: Information sources

- 13.5 List of abbreviations

- Exhibit 175: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio